WHAT WE DO

PASS Reporting for Originators

Quickly & accurately assess potential funding opportunities

Quickly & accurately assess potential funding opportunities

Maintaining deal momentum is a vital key to successful origination. Getting quickly to an accurate understanding of a seller’s receivables, credit control performance and ultimately to a go / no-go decision significantly helps all parties.

We help transaction parties efficiently navigate this process by providing sophisticated analysis and reporting tools. But like most things we do, it all starts with data and a willingness of the seller to provide detailed and accurate receivables data to us. Seller attitudes have steadily changed over time, and most corporates now understand and accept the trade-off between having to share their receivables data and achieving better insurance or funding outcomes.

PASS reports convert data into essential business intelligence

PASS reports convert data into essential business intelligence

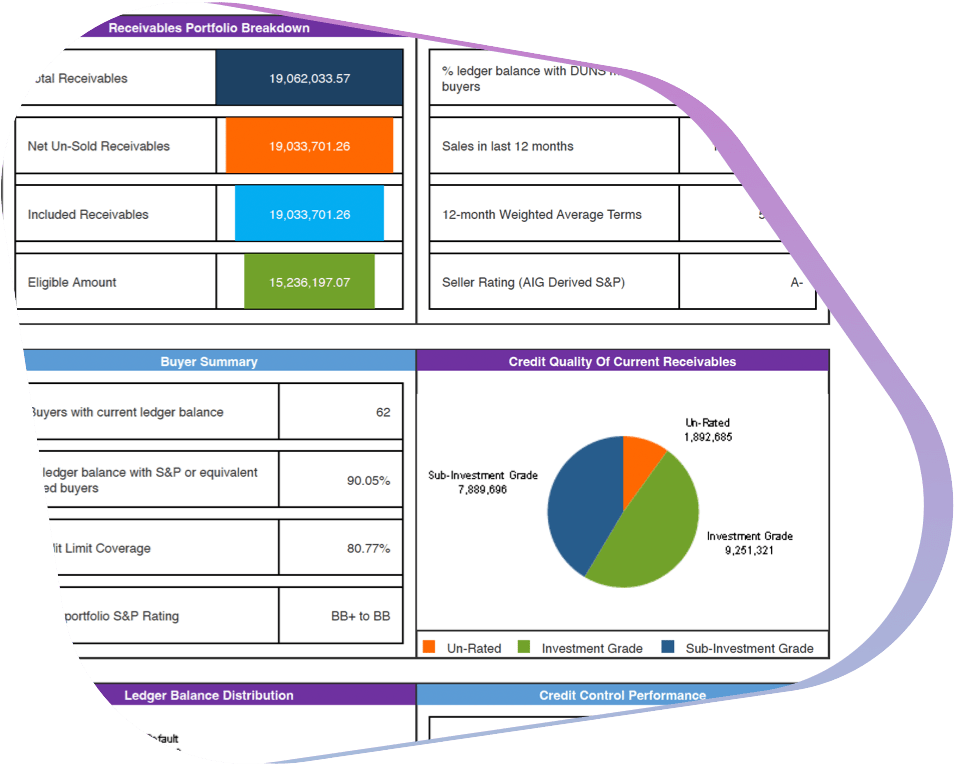

Opportunity analysis often culminates in the production of a PASS Report, an automated 25-page pdf analysis covering:

- Analysis of a corporate’s receivables performance

- Aggregations & concentrations

- Time series analysis and aged debt tracking

- Portfolio risk segmentation

- Debtor risk scoring & debtor credit limits

- Trial eligibility giving an initial indication of likely funding availability

Production of PASS reports is a largely automated process, involving the DUNS matching of debtor records and augmentation of the seller receivables data with third party risk intelligence. The use of sophisticated data analytics and decisioning AI provides a high degree of automation, making PASS report production quick and very scalable.