What we do

Realtime Funding Programs via API’s

Condensing the time from invoice creation to invoice sale

Traditional invoice-backed working capital programs operate on a daily or less frequent cycle, where sellers submit receivables data at the end of the working day. We process the data overnight and establish the new pool of eligible receivables before the start of the next business day.

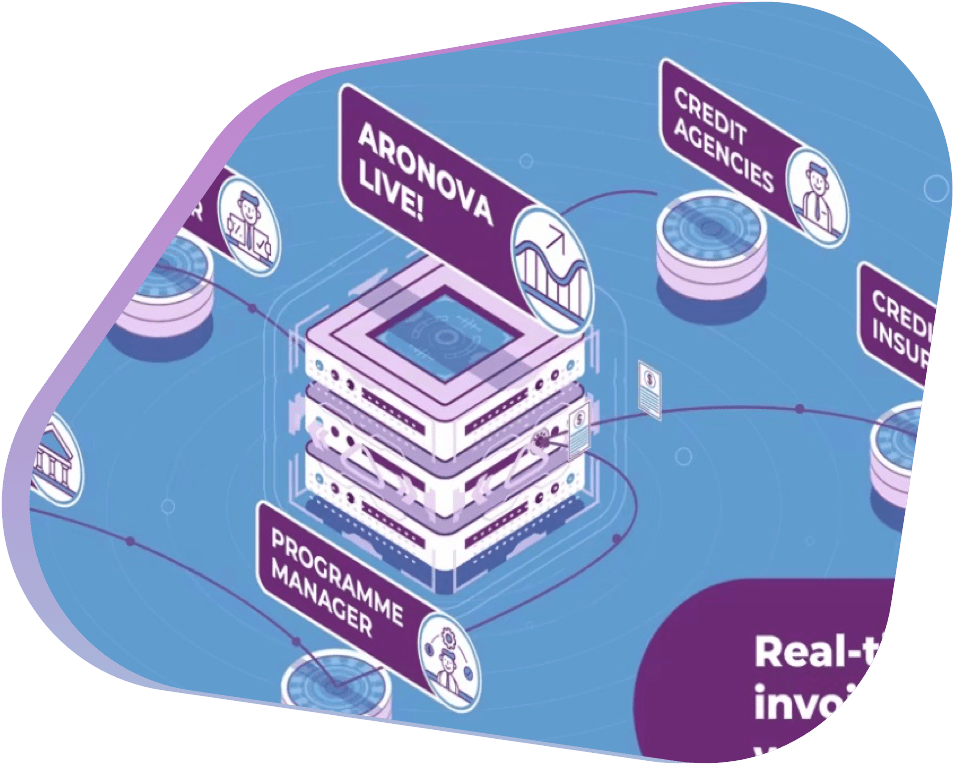

AronovaLive! replaces this traditional model with the real-time exchange of invoice level data using a series of secure APIs. These transform how invoice-backed receivables programs can be delivered and condenses the time from initial invoice presentation to invoice sale.

This means an invoice can now be created and its funding eligibility established in seconds. It can then be sold.

Click on the image on the right to watch our short explainer video.

AronovaLive! supports traditional and newer fintech business models

AronovaLive! supports traditional and newer fintech business models

AronovaLive! presents transaction parties with a real-time, dynamic invoice-backed receivables finance environment that can be used to support traditional operational models, but also supports the newer fintech models entering the market.

This dynamic environment creates different opportunities for funders and how their receivables-backed working capital programs could work.

- Real-time requests for invoice eligibility and debtor credit limits

- Processing cash repayments as they are allocated to invoices, which could immediately result in a change to a debtor credit limit, the freeing-up of capacity within an aggregate cap or a change to the pool of currently eligible invoices

- Assessing the eligibility of individual invoices as soon as they are entered into an accounting system or factoring platform

- Capacity reserving and the ability to reserve capacity during a timeout window. This becomes particularly important when pre-testing invoices for eligibility, in the knowledge that the invoices might be funded at a later point during that day